Blog

The Top Loan Management Software Trends and Innovations

The Top Loan Management Software Trends and Innovations

The financial industry has not been left behind in the recent uptick in technology. Spaces like fintech and the loan management landscape are undergoing a revolutionary transformation fueled by machine learning and integrating AI in software. Today, we’ll be focusing on the loan management software space with a keen look at the latest trends, innovations, and tech.

Today, as per a recent industry report, over 70% of financial institutions are implementing digital loan management technologies to streamline their workflow and enhance customer satisfaction [Source].

Besides, what’s not to like? Imagine streamlined loan origination, advanced loan management tools, AI-powered risk assessment, and a seamless customer experience rolled into one platform.

And that’s just the tip of the iceberg. In 2024, the loan management software industry is taking a giant leap forward with groundbreaking technology.

Top 6 Loan Management Software Trends in 2024

Okay, let’s start by taking a look at the top 6 trends and innovations in loan management software that will generate the maximum buzz in 2024:

End-to-end Automation

Software companies are now working towards a comprehensive approach to streamlining and optimizing the entire lending process using end-to-end automation, from loan origination to management and beyond.

Continuous improvements are made every day to eliminate manual tasks and maximize efficiency by integrating the following technology:

- Automated workflows

- AI-driven decision making

- Robotic Process Automation (RPA)

- Optical Character Recognition (OCR)

- APIs

Artificial Intelligence and Machine Learning Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is undoubtedly one of the most exciting and impactful trends.

Today, machines can process huge amounts of data in a matter of seconds, this technology will allow lenders to make smart decisions based on historical data and current market trends.

Here’s what you will get:

- Streamlined Loan Processes: AI and ML can automate tasks like document verification, fraud detection, and creditworthiness assessment, speeding up the process and reducing manual errors.

- Enhanced Risk Management: By analyzing vast datasets, AI can predict potential defaults, detect frauds and irregular transaction patterns, and recommend customized loan terms, thus minimizing risk for lenders.

- Improved Decision-Making: ML algorithms can analyze loan performance data to identify trends and suggest optimizations, leading to better financial decisions for lenders.

Cloud-based Loan Management Software

Perhaps the most sought-after trend of all, the adoption of cloud-based loan management software is breaking new ground every day.

Moving over traditional on-premise systems, cloud-based solutions operate on remote servers, offering unparalleled flexibility, scalability, and accessibility.

The primary and biggest benefit, though, is access to your loan management software remotely from any device. Cloud computing, in general, is witnessing a massive spike in adoption in the financial services industry, with as many as 98% of organizations using some form of cloud computing [Source].

Here’s why this technology is trending:

- Accessibility & Mobility: Access your loan data and functionality from anywhere around the world and on any device with an internet connection. This empowers dispersed teams and improves convenience for lenders and borrowers alike.

- Enhanced Security & Compliance: Cloud providers invest heavily in robust security measures, potentially exceeding internal IT capabilities. Additionally, adhering to compliance data protection regulations becomes easier with centralized data management.

- Faster Innovation & Updates: Cloud providers continuously update and improve the software, ensuring users benefit from the latest features and functionalities without manual intervention.

- Improved Collaboration & Transparency: Multiple users can access and work on loan data simultaneously, fostering better communication and streamlined workflows. Real-time data visibility boosts transparency for both lenders and borrowers.

Open Banking

Another spectacular trend in loan management software is the increasing adoption of open banking with further advancements in how easily financial institutions can collaborate and bring forth exciting new features for their customers. We’ve already seen the big shifts with regards to automation in the accounting space

API adoption and consolidation of borrower data is allowing for real-time access to financial information and offering personalized loan products tailored to individual borrowers’ financial profiles.

Quantum Computing

Although still in its development phase, quantum computing has massive potential to alter the course of digital lending and management. Quantum computing utilizes the principles of quantum mechanics to perform calculations.

But these aren’t just any calculations; these are calculations that our traditional conditions cannot handle. This can be revolutionary for analyzing vast amounts of financial data (more vast than AI and ML are capable of) and solving previously intractable problems.

Quantum computing has the potential to significantly enhance risk assessment models, optimize portfolio management strategies, and accelerate decision-making processes.

The computational capability of quantum computing is helping lending institutions to gain deeper insights into borrower behavior, identify trends and patterns more effectively, and make precise data-driven decisions with unprecedented speed.

Granted, it is not currently a mainstream feature, but quantum computing is a trend worth keeping an eye on due to its ability to tackle complex problems often faced in the lending industry.

Blockchain Technology for Secure and Transparent Loan Management

Bet you didn’t know that blockchain technology is not limited to cryptocurrency anymore. The Fintech sector is witnessing an increased adoption of blockchain technology for advanced security features and transparent loan management.

Here’s how it works:

Blockchain is a distributed ledger technology, meaning a secure record of transactions is shared across a network of computers.

Each loan interaction, from origination to repayment, is recorded as a tamper-proof block on the chain, accessible to all authorized participants. What’s fascinating is that its decentralized nature ensures that no recorded transaction or data can be altered or tampered with.

The result:

- Unparalleled security and elimination of a single point of failure.

- Absolute transparency for all authorized users.

- Reduced costs and efforts that come with manual deployment of security features.

- Enhanced operational efficiency.

What Are The New Customer Expectations?

With such powerful developments on the way, your customers expect more advanced lending solutions that make the loan lifecycle easier and safer.

Some of the tech listed above have already started making headway, and customers realize that. So, you should be aware of your customers’ expectations now.

Here’s a little peek into what they are expecting:

Convenience and Efficiency:

- Cloud Access: Customers want to manage their loans anytime, anywhere.

- Quick Results: Faster loan approval with pre-filled forms, e-signatures, and automated verification.

- Self-Service Loan Management Tools: Online portals for payment processing, account management, and document access.

Transparency and Communication:

- Real-time loan Information: Instant access to loan balances, payment history, and other relevant details.

- Proactive Communication: Timely updates on loan status, potential issues, and upcoming deadlines.

- Personalized Insights: Data-driven recommendations and financial guidance based on individual circumstances.

Security and Trust:

- Robust Data Security: Assurance that their personal and financial information is protected using advanced encryption and fraud prevention measures.

- Clear and Compliant Processes: Transparency regarding interest rates, fees, and loan conditions to avoid hidden costs or surprises.

- Accessible Customer Support: Easy access to helpful and knowledgeable representatives when needed.

Conclusion

As with any industry, the landscape is forever changing, and adapting is essential. From cloud-based lending software to the integration of AI and the adoption of blockchain technology, lending institutions are embracing cutting-edge technologies. This change is revolutionizing their operations and better serving the customers.

So, if you also want to stay current and ensure that you are providing your customers the best of both worlds — your expertise and trending technologies, be ready to embrace innovation.

By embracing innovation, prioritizing customer-centricity, and leveraging the power of technology, you can position yourself as an industry leader in 2024 and beyond.

Want to learn more about how custom software is making huge shifts across different industries today?

Join more than 1500 founders who receive the latest podcast episodes, in-depth articles, tech trends, and even custom workbooks delivered straight to their inboxes!

Want to speak to us?

Schedule a call today, we’d love to hear about your project!

Read more

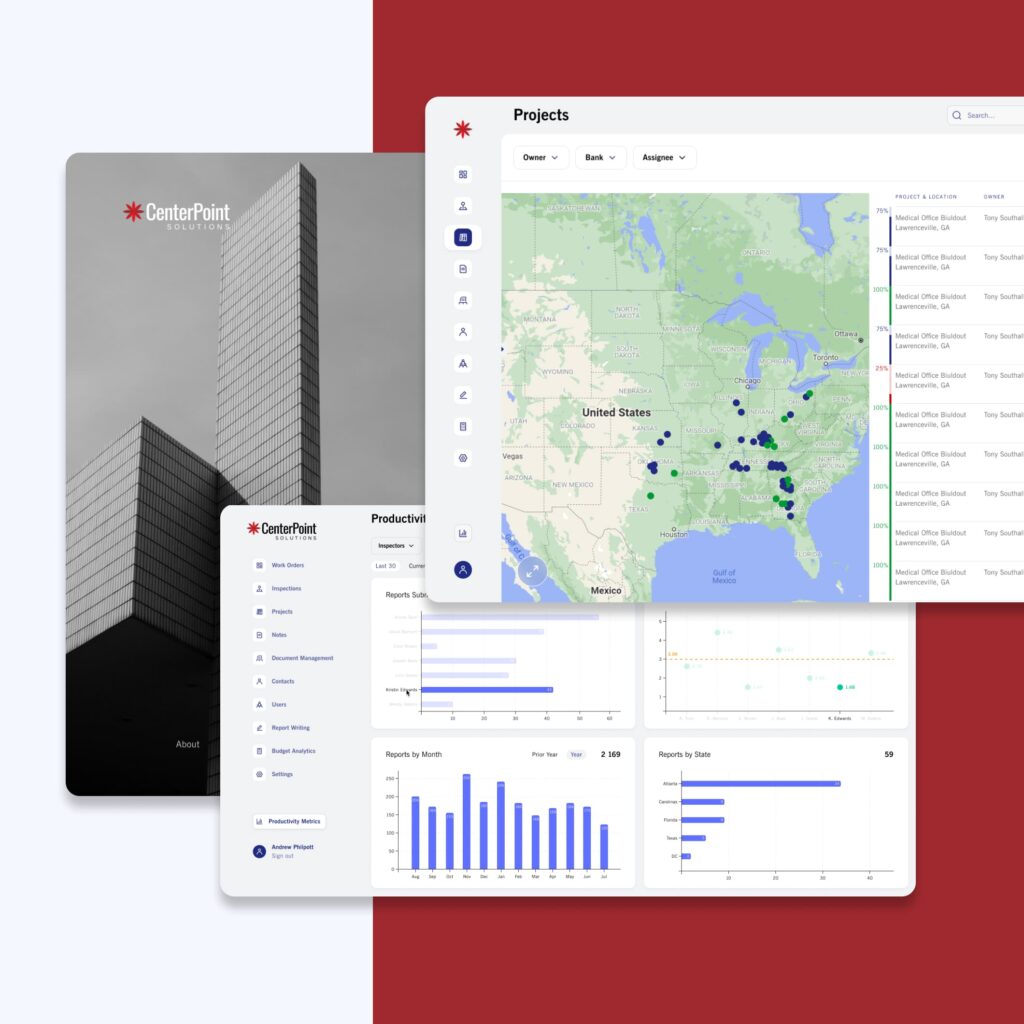

Case study:

Centerpoint Solutions

How Centerpoint grew to manage 500 commercial construction projects per month in 12 mo...

Bootstrapping a SaaS: The Strategies Every Founder Can Learn

Streamlining Operations With Mobile Device Management (MDM) Solutions

Building a Future-Proof SaaS: A Founder’s Guide to Tech, Teams, and Transitions

How to Find and Vet Developers in Eastern Europe & Latin America

Create a free plan for growth

Speak to Victor and walk out with a free assessment of your current development setup, and a roadmap to build an efficient, scalable development team and product.

“Victor has been great. Very responsive and understanding and really knows his stuff. He can go the extra mile by tapping into his prior experiences to help your company out. Really enjoyed working with him.”

Founder of Agency360

Victor Purolnik

Trustshoring Founder

Author, speaker, and podcast host with 10 years of experience building and managing remote product teams. Graduated in computer science and engineering management. Has helped over 300 startups and scaleups launch, raise, scale, and exit.