Blog

The Essential Legal and Strategic Considerations for SaaS Founders

The Essential Legal and Strategic Considerations for SaaS Founders

Introduction

It’s probably never been harder for a founder to build and scale their business today, with the growing competition and advances in technology. Today, we’ll be taking a look at every legal and strategic consideration that SaaS founders should be looking at, giving you the tools to prepare your business for contracting, selling, or a potential exit.

We’ll be leaning on our explosive podcast series with Omeed Tabiei, Lawyer and managing partner of Optimist Legal, a SaaS law firm that focuses on providing founders with the guidance they need from incorporation, all the way through to selling their businesses.

The Most Common Intellectual Property Mistake in SaaS

If you’ve been following us for a while, we’ve talked about this before. One of the biggest mistakes in SaaS is not taking the necessary steps to make sure that you actually own all the rights to the company assets.

These include all the code, marketing materials, collateral, and everything that employees, contractors, and 3rd parity create on behalf of the company. This is where you should make sure that everyone who works with your SaaS signs a property inventions assignment agreement.

The Property Inventions Assignment Agreement.

What is a Property Inventions Assignment Agreement? (PIAA) It is an agreement signed between your company and anyone who works for the company, including freelancers, that clearly assigns everything they create to the company.

This can be as robust as a couple of pages of a document or as small as a line on a contract.

Why Founders Overlook IP Agreements

When founders prepare to sell their business, this innocuous document has been known to derail and sometimes collapse acquisitions. It’s one of the first things that an Investor will look for because, without it, you don’t really own the assets and, in turn, the business.

We’ve seen companies have to track down developers who worked on their code years ago to get them to sign this document. You do not want to be there.

“When founders go to sell their company…the acquirer is going to get a list of all independent contractors, employees, and vendors that have ever worked with the company. They’re going to go through it…looking for a robust document that specifically says these people have assigned all intellectual property created for the company.” – Omeed Tabiei, Lawyer and Managing Partner at Optimist Legal.

If a company does not have proper agreements signed, it is very difficult to sell the business.

The Basics of Equity Distribution in SAAS

Planning to distribute equity in your SaaS company, the first thing Omeed talked about here was incorporation. Obviously, your company has to be set up to distribute equity in a way that makes sense for SaaS.

What Is the Best Place to Start a Business in the US?

The best place to start a business in the US, especially if you plan to distribute equity, is Delaware. Start a C Corporation in Delaware because, in terms of corporate law, Delaware is the most established. If any issues arise, you will get an expedited hearing with an established library of case law, specifically with respect to corporations.

“Why a C Corporation? Because C corporations are equipped to issue equity. So LLCs can’t issue equity the same way C corporations can; C corporations can create different levels of equity and different stock classes. LLCs are actually not equipped to issue equity. They issue typical units. I mean, you can call them stock, but they’re not stock in the same way that corporations are.”

Setting Up the Capitalization Table (Cap Table) and Equity Incentive Plans

The next thing you need to think about when planning to issue equity is your cap table. This is another thing that investors will take a look at. You need to make sure that you have enough authorized and outstanding shares to be able to distribute equity.

Finally, Omeed also talked about the importance of setting aside anywhere between 10-20% for your equity incentive plan. This is very important when it comes to motivating your employees and making sure you are getting the best possible version of them when they are there.

Equity Vesting Schedules and Investor Expectations

A vesting schedule is a term used to describe a time period during whereby benefits, such as equity, become available for employees to exercise. Usually, businesses that have ESOPs (employee stock ownership plans) set out a vesting schedule that incentivizes employees to continue working for the business.

“Typically, the vesting schedule…is four years. So, if I issue you a million shares…you will own those million shares on the anniversary of your fourth year.”

A one-year cliff is also common, meaning that the employee doesn’t start vesting shares until after one year, and from there, shares vest month-by-month.

The 83(b) Election to Optimize Tax Benefits

Finally, something that employees need to be aware of is the 83(b) election. It’s a relatively simple filing that shifts the taxation burden so that the capital gains tax is minimized.

It’s important for employees to file this within 30 days of receiving the equity grant to avoid increased tax obligations later.

Remote Hiring: The Legal Essentials and Contracting Tips

Remote work has really gathered steam beyond the pandemic, with a lot of companies realizing that you can hire top talent globally. So, what are the legal hurdles that you need to be aware of and overcome?

Many startups are now moving towards outsourcing and outsourcing software development. The challenge that is now arising is jurisdiction. If things go wrong in terms of fulfilling the contract, then who will you go to?

The way to mitigate this is to obviously make sure you first do a lot of due diligence and background checks on who you are hiring, and finally, the very best way is to go through trusted third parties who specialize in vetting, sourcing, and hiring remote employees.

A robust service agreement is another thing that you need to be aware of when hiring and contracting remotely. This agreement should clearly outline the deliverables, timelines, payment terms, alongside confidentiality clauses and intellectual property ownership.

Protecting Your SaaS Idea From Being Stolen

We asked Omeed, one of the most common questions that we get at trustshoring: How can I protect my SaaS idea from being stolen?

We’ve talked about this before from the point of view of code security and protecting your codebase from developers.

Now, NDAs or non-disclosure agreements are often touted as a method of protecting your ideas, and they are one of the first things that people think about. But this won’t work or even end well.

“If you want to raise funding…and you go to investors and ask them to sign an NDA for an idea, you’re not going to be able to get any traction.”

Why Execution is the Ultimate Protection

The best way to protect your startup idea from being stolen is to create it. Create it, make it the best and that way you do not have to worry about it being stolen.

Remember, while ideas themselves cannot be copyrighted, products, logo design, and branding elements can. You might think of trademarking, but unless your idea is something novel that stands out and can potentially ‘push the space forward,’ then it’s not going to be worth it.

Conclusion

As SaaS continues to expand with the rise of AI, so will the legal hurdles and challenges that founders need to be aware of.

From remote hiring, contracting, and making sure that all the people who work for you are assigning all their creations to the company to knowing what type of company structure you need in order to distribute equity the right way.

It’s important to make sure that you are working with a competent lawyer like Omeed Tabiei and Optimist Legal to make sure that you are covered from incorporation all the way to fundraising and exiting your business.

FAQ: Essential Legal and Strategic Considerations for SaaS Founders

1. What is a Property Inventions Assignment Agreement, and why is it important for SaaS companies?

A Property Inventions Assignment Agreement is a legal document that assigns any intellectual property (IP) created by employees, contractors, freelancers, and any other third-party service providers to the SaaS company. This agreement is crucial because it ensures that any code, design, marketing collateral,l or other IP created for the company belongs to the company itself. This becomes very important during acquisitions, as acquirers will review contracts to verify that IP rights are fully owned by the company.

2. Why do SaaS founders need to form a C corporation, particularly in Delaware?

C corporations allow for structured equity distribution, including the creation of stock classes and the issuance of shares. Delaware is a favored jurisdiction due to its established corporate laws, experienced legal courts, and expedited processing of corporate matters. This structure is essential for founders planning to raise funds, as investors expect to see a clear capitalization table (cap table).

3. What is a cap table, and how does it relate to equity distribution?

A cap table (capitalization table) is a detailed document outlining the ownership of shares in a company. It includes the distribution of shares to founders, employees, and investors, as well as shares set aside for an equity incentive plan. SaaS founders should structure their cap table carefully, typically reserving 10-20% of shares for an equity incentive plan, which is used to attract and retain top talent.

4. How does equity vesting work in a SaaS company, and why is it important?

Equity vesting is a term used to describe a time period during whereby benefits such as equity become available for employees to exercise.

This ensures that employees, including founders, earn their equity by contributing to the company’s growth over time. Investors prefer vesting schedules because they align the interests of the team with the company’s long-term success, making it less likely for team members to leave with large stakes in the company without having put in significant work.

5. What is the 83(b) election, and how does it benefit SaaS founders?

The 83(b) election is a tax filing that allows equity recipients to pay taxes on the value of their shares at the time of grant rather than at the time they vest. Filing this within 30 days of receiving equity can significantly reduce tax obligations, as it locks in the value at an early stage when the stock price is low, thus avoiding higher taxes later if the company’s value increases.

6. What are the main challenges in hiring remote developers for a SaaS company?

Hiring remote developers introduces challenges, particularly in areas like jurisdiction, enforceability of contracts, and varying legal standards across countries. Founders must consider who to pursue legally if a contract is breached and where that enforcement will take place. This complexity makes it essential to work with reputable, vetted vendors or intermediaries to ensure quality and legal reliability.

7. What should be included in a service agreement with a remote developer?

A service agreement with a remote developer should include:

- Scope of Work: Detailed description of deliverables and timelines.

- Payment Terms: A Clear schedule and method for payment.

- IP Ownership: Clauses assigning ownership of all work products to the company.

- Confidentiality: Agreement to protect proprietary information.

- Indemnity: Provisions for the developer to cover legal costs in case of IP disputes.

8. How can SaaS founders protect their idea from being stolen?

There are several ways to protect a SaaS idea:

- NDAs: These can prevent third parties from disclosing your idea, though they may not always be enforceable or practical, especially with investors.

- Trademarks: Protect your brand name and logo to maintain market presence.

- Provisional Patents: If the product includes a novel technological process, a provisional patent may provide limited protection.

- Execution Over Ideation: The best protection, according to legal experts, is executing the idea well and establishing a strong market presence, making it difficult for competitors to replicate.

Read more

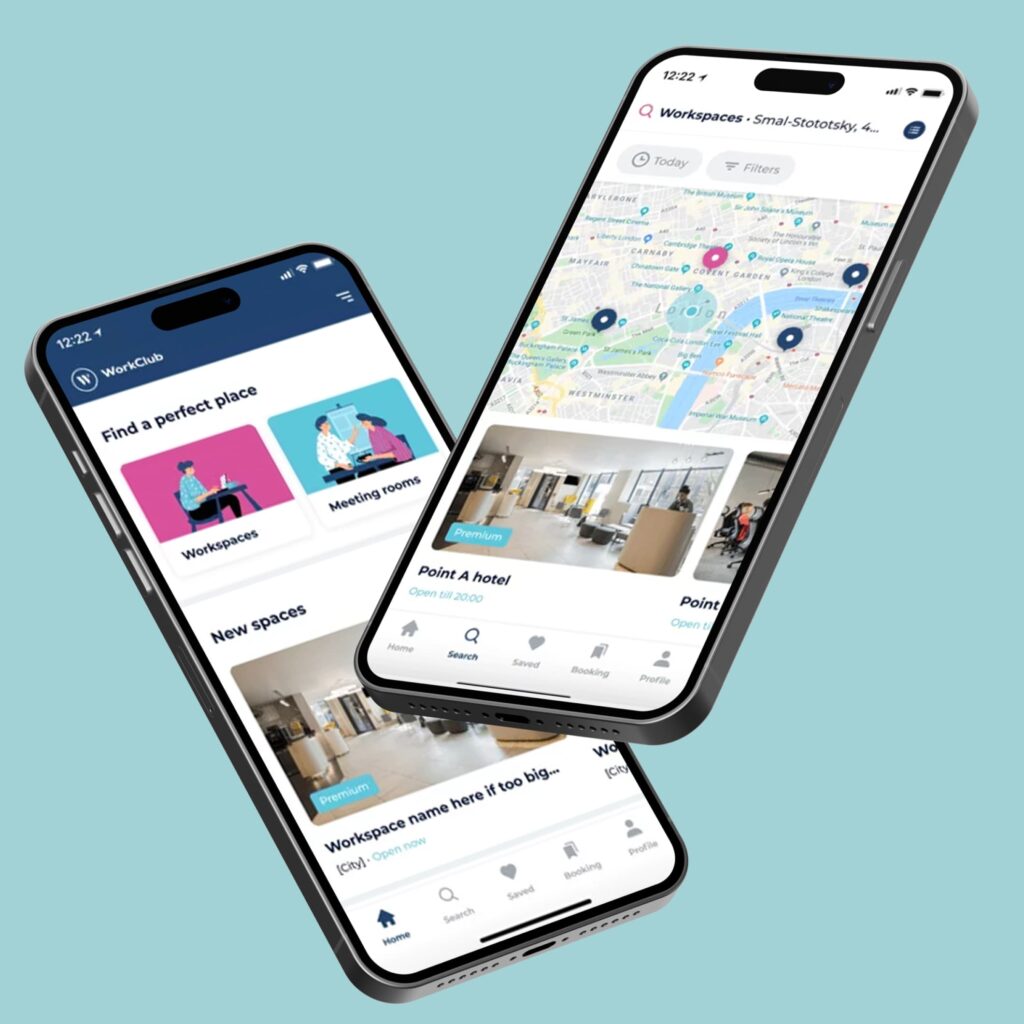

Case study:

Workclub

How Workclub found the right development team to build MVP in just 6 months.

How to Scale Your SaaS Business Using Agile Methodologies

Unlocking Remote Work Success: Annual Meetups, Tech Debt, and Growth Strategies for 2025

Building a Telehealth Startup to Change the Face of Health Tech During and After COVID-19

The Possibilities with ChatGPT and How to Use It in Your SaaS

Create a free plan for growth

Speak to Victor and walk out with a free assessment of your current development setup, and a roadmap to build an efficient, scalable development team and product.

“Victor has been great. Very responsive and understanding and really knows his stuff. He can go the extra mile by tapping into his prior experiences to help your company out. Really enjoyed working with him.”

Founder of Agency360

Victor Purolnik

Trustshoring Founder

Author, speaker, and podcast host with 10 years of experience building and managing remote product teams. Graduated in computer science and engineering management. Has helped over 300 startups and scaleups launch, raise, scale, and exit.